The Single Strategy To Use For Offering More Than Asking Price

Table of ContentsThe Definitive Guide for Offering More Than Asking Price3 Simple Techniques For Offering More Than Asking PriceThe Buzz on Offering More Than Asking PriceGetting My Offering More Than Asking Price To WorkOffering More Than Asking Price - An OverviewWhat Does Offering More Than Asking Price Do?

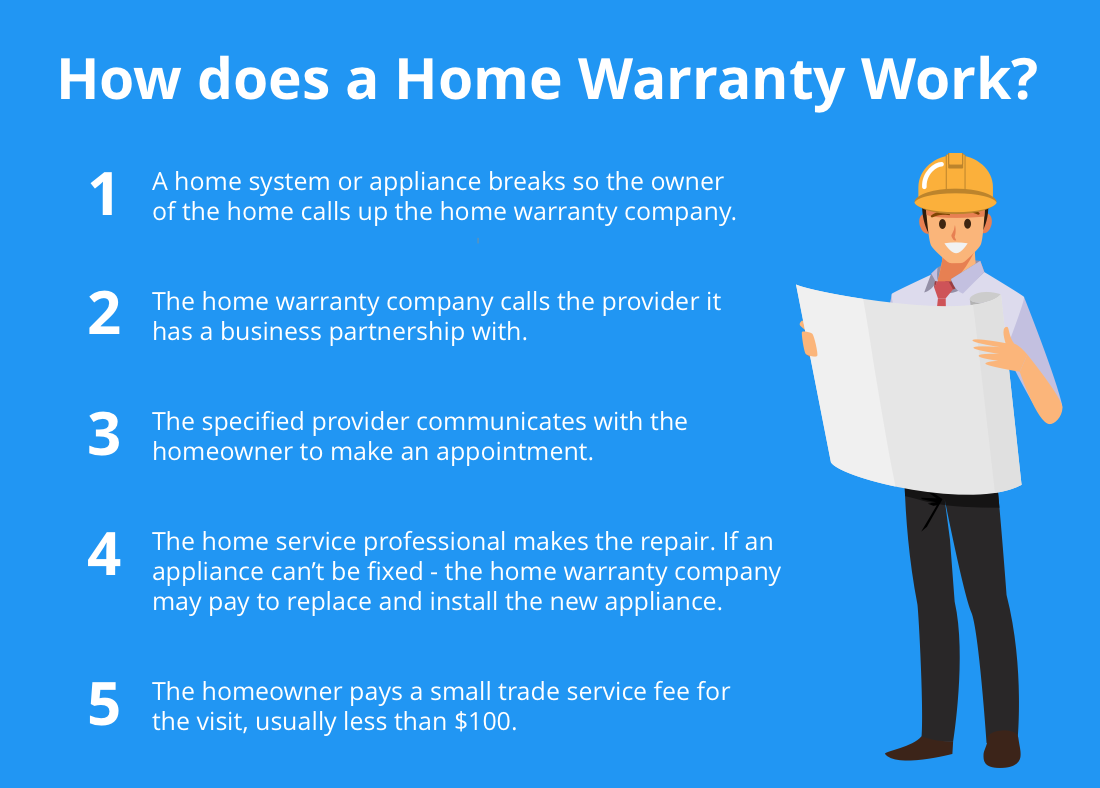

Have you ever questioned what the difference was in between a residence service warranty as well as home insurance policy? Do you need both a home warranty and also house insurance, or can you obtain simply one? A house warranty secures a home's inner systems and also appliances.

What Does Offering More Than Asking Price Mean?

What does a home guarantee cover? A residence warranty covers the primary systems in a home, such as a residence's home heating, cooling, pipes, and also electric systems. A home guarantee might additionally cover the bigger home appliances in a house like the dishwasher, stove, refrigerator, clothing washing machine, and also dryer. Home guarantee firms generally have different plans offered that give insurance coverage on all or a choose few of these products - offering more than asking price.

For instance, if a commode was dripping, the residence service warranty firm would pay to take care of the toilet, but would not pay to repair any water damages that was triggered to the structure of the home since of the dripping commode. Fortunately, it would be covered by insurance coverage. What is house insurance? If a house owner has a mortgage on their residence (which most home owners do) they will certainly be needed by their home loan lender to buy residence insurance policy.

Some Known Details About Offering More Than Asking Price

House insurance coverage might additionally cover clinical expenditures for injuries that people received by being on your building. When something is harmed by a catastrophe that is covered under the house insurance coverage policy, a home owner will certainly call their residence insurance firm to submit a claim.

Property owners will normally have to pay a deductible, a fixed amount of cash that comes out of the home owner's pocketbook prior to the house insurer pays any type of money towards the case. A house insurance policy deductible can be anywhere in between $100 to $2,000. Usually, the greater the deductible, the reduced the annual premium cost - offering more than asking price.

What is the Difference In Between House Warranty and Home Insurance Policy A residence service warranty contract as well as a home insurance coverage operate in comparable ways. Both have an annual premium and an insurance deductible, although a house insurance premium and deductible is usually much greater than a house service warranty's. The primary differences between residence warranties and house insurance policy are what they cover.

Offering More Than Asking Price for Beginners

Another difference between a house service warranty as well as home insurance policy is that house insurance coverage is typically required for home owners (if they have a home mortgage on their house) while a house guarantee plan see this site is not needed. A house warranty as well as residence insurance policy offer defense on different parts of a home, and together they can safeguard a property owner's spending plan from costly fixings when they certainly surface.

They will certainly work together to offer protection on every part of your home. If you have an interest in acquiring a home guarantee for your home, have a look at Landmark's house guarantee plans and also rates right here, or demand a quote for your home right here.

6 Easy Facts About Offering More Than Asking Price Described

"Nonetheless, the a lot more systems you include, such as swimming pool protection or an additional furnace, the higher the price," she says. Adds Meenan: "Costs are commonly flexible too." In addition to the annual cost, house owners can anticipate to pay typically $100 to $200 per solution call visit, depending on the sort of contract you purchase, Zwicker notes.

Residence service warranties do not cover "things like pre-existing conditions, animal infestations, or remembered products, discusses Larson."If people do not review or comprehend the coverages, they may finish up believing they have insurance coverage for something they don't.

"We paid $500 to authorize up, and after that had to pay one more $300 to clean up the primary drain line after a shower drain back-up," says the Sanchezes. With $800 expense, they assumed: "We didn't benefit from the residence a knockout post warranty whatsoever." As a young pair in one more residence, the Sanchezes had a challenging experience with a home service warranty.

8 Simple Techniques For Offering More Than Asking Price

When the specialist wasn't satisfied with a reading he obtained while examining the furnace, they say, the company would certainly not consent to insurance coverage unless they paid to change a $400 part, which they did. While this was the Sanchezes experience years back, Brown confirmed that "checking every major appliance before offering protection is not a sector criterion."Always ask your company for quality.